City will teach financial planning to teens

The District government is hoping to make financial planning a part of the basic curriculum in the city’s high schools.

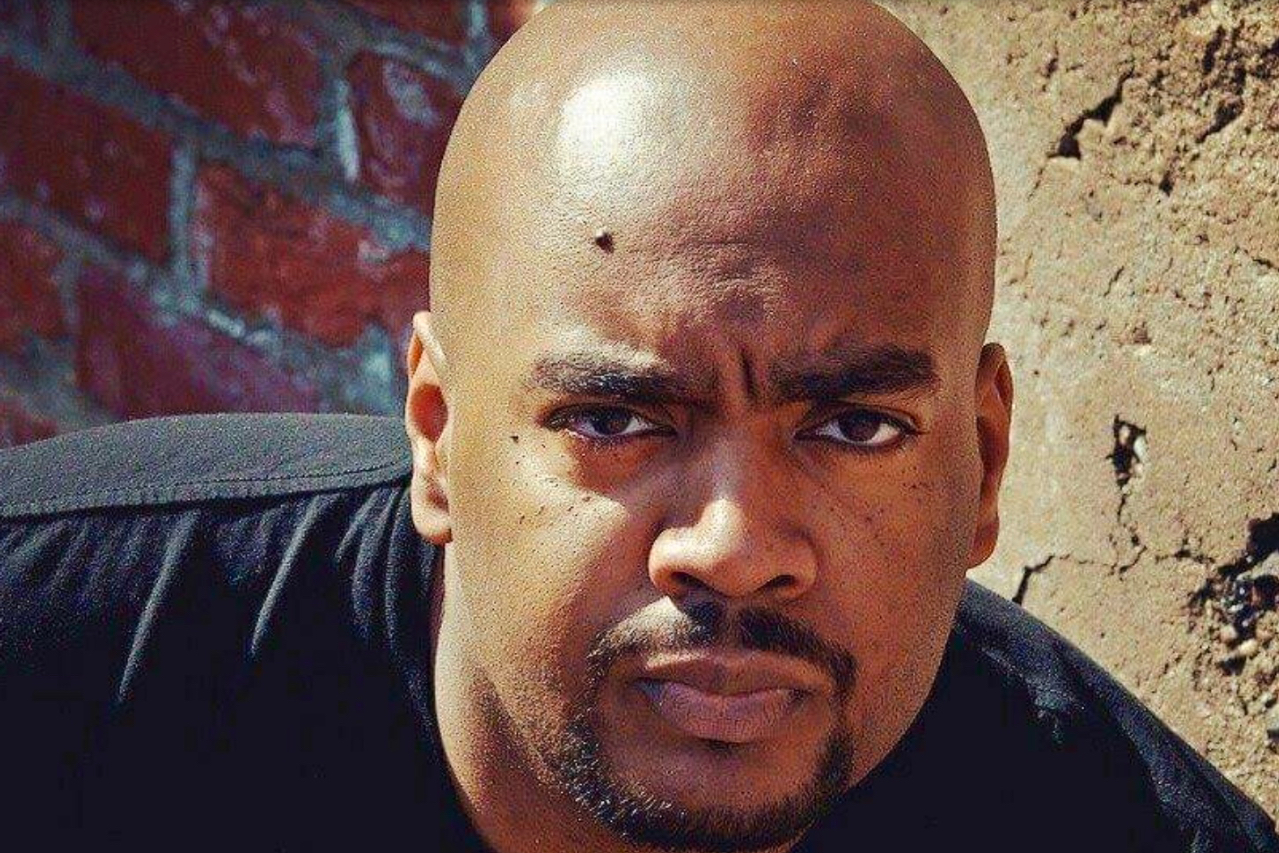

Chris Sears. Courtesy photo.

Chris Sears has dreamed of joining the Marines since he was a child.It is in his blood: His father was a captain, and his grandfather before that was a major. But the 23-year-old D.C. native got a rude awakening when he realized he’ll have to begin paying back $120,000 in college loans before he even begins his first active-duty assignment in Guantanamo Bay, Cuba in May 2020. Sears will have to start dishing out $1,200 a month, which is about half his monthly salary, to start paying off his debt.

“I was shocked! I didn’t understand that I would have to start paying that much. I thought joining the military would help me with it,” Sears said.

Sears isn’t the first college student to have crushing loan debt. Student loan debt has surpassed credit card debt in the past 10 years. Much of this is due to the soaring cost of higher education, in addition to high school students’ lack of financial literacy.

“I never learned any of this. I never learned how to balance a checkbook, or how to pay taxes. I just accepted the student loans because I felt like I had no choice,” he said.

According to Standard & Poor’s Global Financial Literacy Survey in 2015 only 30 percent of Americans were able to answer three simple financial questions about inflation, interest compounding and risk diversification. The financial literacy crisis comes at a time when Americans are being asked to take accountability for their own economic well being.

Maybe the first serious financial decision many Americans must make is how much debt they are willing to take on to go to college. Unfortunately, like Sears, students don’t understand the consequences of taking on debt until it’s too late.

At-Large Councilmember Robert White Jr. Courtesy photo.

The District government is hoping to change this pattern by making financial planning a part of the basic curriculum in the city’s high schools. One pioneer towards reform is Councilman-At-Large, Robert White, Jr., who introduced the “Financial Literacy Education in Schools Act of 2019” last April. It establishes a financial literacy education program by requiring the Office of the State Superintendent of Education to develop a financial literacy course to be piloted in all D.C. public high schools no later than the 2020-2021 school year. Currently under council review, this Act will establish economic and monetary classes in schools citywide.

“I teach my children to wear helmets when riding their bicycles. I teach them about the branches of American government. Financial literacy is just as important,” White stated. “Students here in D.C. are at a disadvantage not knowing about saving money, about how to file taxes, about how to balance a checkbook, about how to invest, about student loans, and even how to pay rent and bills. We need to empower our children so they can make better choices for their future.”

Meanwhile Sears, a former DCPS student, is pleased that students will get an opportunity he never had. “I hope this program can help students in high school make better decisions, and not do what I did. I wasn’t informed. I had no idea and no help.”

For information about the act contact https://dccouncil.us/legislation/